BTC Price Prediction: Navigating Near-Term Volatility for Long-Term Growth

#BTC

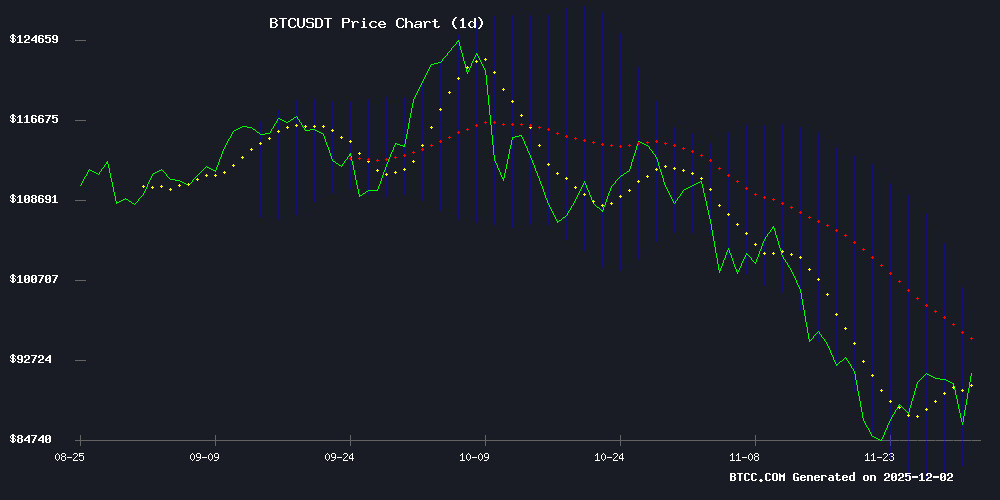

- Critical Technical Inflection Point: Bitcoin's price is currently testing major support near $82.7K after falling below its 20-day moving average. The bearish MACD crossover suggests near-term momentum is weak, making the defense of this support zone crucial for the medium-term trend.

- Cautious Market Sentiment Dominates: News headlines reflect a market grappling with macroeconomic uncertainty and regulatory actions, overshadowing positive fundamentals like continued institutional accumulation. This aligns with the technical picture of consolidation and risk.

- Long-Term Trajectory Remains Bullish: Despite near-term headwinds, the long-term forecast framework remains positive, driven by Bitcoin's fixed scarcity, growing adoption as a digital reserve asset, and its evolving role in the global financial system over the coming decades.

BTC Price Prediction

Technical Analysis: BTC at Critical Juncture Below Key Moving Average

According to BTCC financial analyst John, Bitcoin's current price of $86,843.47 presents a pivotal technical picture. The asset is trading below its 20-day moving average of $90,344.08, which often acts as dynamic resistance in a bearish short-term structure. The MACD indicator, with a value of -1,613.11, confirms a bearish momentum crossover, suggesting selling pressure may persist in the NEAR term.

John notes that the Bollinger Bands offer a clear framework for potential movement. With the price below the middle band, the immediate support level is identified at the lower band near $82,752.82. A decisive break and close below this level could trigger a sharper correction. Conversely, a reclaim of the 20-day MA is needed to shift the near-term bias back to neutral or bullish, with the upper band near $97,935.34 representing a significant resistance target.

Market Sentiment: Caution Prevails Amid Macro Pressures and Regulatory Actions

BTCC financial analyst John assesses the current news flow as contributing to a cautious, if not slightly negative, market sentiment. Headlines highlighting Bitcoin 'stalling' at resistance, facing 'macro pressures,' and a 'risk-off' start to December align with the technical picture of consolidation and potential downside. The shutdown of a major cryptomixer by Europol, while positive for regulatory clarity, can temporarily dampen sentiment among certain market participants.

John points out that bullish counter-narratives exist but appear secondary in the current context. News of MicroStrategy accumulating more bitcoin and innovative models like WebX using operational revenue for BTC purchases indicate strong foundational demand. However, these are being overshadowed by immediate macro concerns and price action failing to break key levels, leading to a sentiment of watchful waiting.

Factors Influencing BTC’s Price

Bitcoin Stalls Below $86K as Remittix Gains Traction Amid Market Uncertainty

Bitcoin's rally falters near key resistance at $92,000-$93,000, with the asset now consolidating around $86,000. Analysts watch the $88,000-$89,000 zone as critical for avoiding a retest of November lows near $78,000. The December 1 drop to $84,005 erased $150B in market value, pushing RSI toward oversold territory.

Meanwhile, Remittix (symbol not specified) emerges as a standout performer, delivering product milestones ahead of schedule. The PayFi project's organic growth—without aggressive marketing—contrasts with Bitcoin's macro-driven volatility. Market structure parallels to 2021's deep-correction phases are drawing attention.

Bitcoin (BTC) Price Prediction 2025: December Volatility Could Mirror 2020 Moves

Bitcoin shows early signs of a mirror pattern from 2020, hinting at volatility and opportunities. Traders note the same pain, setup, and window as previous cycles—sharp pre-pump declines followed by rallies. Technical analysis suggests BTC maintains key structural support, though bulls prefer avoiding a retreat to $80,000.

MSTR stock trades below its Bitcoin-backed valuation, signaling potential upside. Market voices remain divided—caution wars with ambitious targets. December historically amplifies volatility, particularly in crypto’s year-end cycles.

Europol-Led Operation Shuts Down $1.4B Cryptomixer Laundering Platform

German and Swiss authorities, supported by Europol and Eurojust, dismantled CryptoMixer, a cryptocurrency mixing service accused of laundering over $1.4 billion tied to ransomware groups. The operation, conducted in Zurich from November 24 to 28, 2025, resulted in the seizure of three servers, 12 terabytes of data, and €25 million ($27 million) in Bitcoin.

Cryptomixer.io, whose core infrastructure operated on Swiss servers with German-hosted domains, facilitated anonymous transactions for criminal proceeds. Europol emphasized the seizure will aid investigators in tracing illicit flows and disrupting associated networks.

Bitcoin Tests Critical Support as Macro Pressures Mount

Bitcoin breached the $84,000 threshold in early December 2025 amid institutional sell-offs and tightening Asian liquidity. The move signals growing caution among Wall Street players and Asian investors facing rate hikes and geopolitical strain.

Two levels now dictate the narrative: holding $85,200 could stabilize the market, while failure at $87,000 risks accelerating declines. December's volatility may present accumulation opportunities, though traders remain wary of cascading liquidations.

The cryptocurrency's trajectory this week will likely determine whether 2025 concludes as a year of consolidation or correction. Market depth has thinned considerably, amplifying price swings during US trading hours.

MicroStrategy Bolsters Bitcoin Reserves Amid Market Volatility

MicroStrategy has fortified its Bitcoin position with a $1.44 billion reserve fund, safeguarding dividend payments on preferred shares. The move follows a rapid $11.7 million acquisition of 130 BTC, expanding its holdings to 650,000 coins—3.1% of Bitcoin's total supply.

Despite this aggressive accumulation strategy, the company has tempered its 2025 targets. The reserve, raised through a nine-day share sale, provides a 24-month dividend cushion against crypto market turbulence.

Bitcoin Stalls at $92K Resistance Amid Global Macro Pressures

Bitcoin faces a critical juncture after a $7,000 plunge from its $92,000 resistance level, now consolidating near $86,000. Market technicians warn that holding the $88,000-$89,000 support zone is essential to prevent a retest of November's $78,000 lows.

The December 1 sell-off erased $150 billion in crypto market capitalization, with intraday lows hitting $84,005.13. Analysts point to oversold RSI conditions suggesting potential for rebound—if buyers defend key levels.

Bank of Japan Governor Kazuo Ueda's hawkish tilt on rates strengthened the yen, creating headwinds for risk assets globally. 'Liquidity hunts and short-term manipulation may be exacerbating moves,' noted one trader.

WebX Pioneers Bitcoin Accumulation Through Operational Revenue

Bill Dafflon, Co-founder and CEO of AI music venture Wondera.AI, has invested in WebX International Holdings Limited—the world's first Bitcoin Accumulation Company (BAC). Unlike traditional digital asset treasuries that raise capital to buy and hold Bitcoin, WebX accumulates BTC directly through operational revenue and targeted investments, reinforcing the Bitcoin ecosystem.

Originally a manufacturing firm, WebX now focuses on harnessing fragmented global computation power to create a finance-enabled network. Backed by leaders in finance, technology, and blockchain, the company converts energy and computation into digital value, positioning itself as a bridge between infrastructure and growth in the digital age.

Bitcoin Price Prediction: Can BTC Price Hold $86K Amid Trendline Resistance and $93K Breakout Hopes?

Bitcoin's recent volatility has market participants questioning whether the cryptocurrency can sustain its momentum after nearing $100,000 in October. The Relative Strength Index (RSI) on the 60-minute chart approaches oversold territory at 16, signaling potential short-term buying pressure if key support levels hold.

Analysts are closely monitoring critical technical thresholds. Crypto strategist Heisenberg notes that a decisive break above $93,000 is necessary to maintain upward momentum, with $86,000 serving as crucial support. A failure to defend this level could open the door to a deeper correction toward $80,000.

The $93,000 mark aligns with a descending trendline that has recently acted as resistance on daily charts. Despite October's all-time highs, Bitcoin has seen a 5% year-to-date decline by late November, reflecting the market's ongoing volatility and mixed signals.

When Bitcoin Mining Turns a Cold Winter Into Something Cozy

Bitcoin mining has evolved from an industrial, noisy process into a quiet, home-friendly activity that doubles as a heat source during winter. Modern miners now operate with reduced noise and emit warmth akin to radiators, making them ideal for residential use. This shift has turned mining into a comforting household feature, blending utility with financial gain.

The warmth generated by these devices is neither harsh nor wasteful, efficiently converting energy into both heat and Bitcoin rewards. For many, the experience of entering a room warmed by a mining rig underscores the tangible value of energy expended—transformed into digital currency.

Across Europe, thousands of households are embracing this dual-purpose technology, redefining mining as an intimate part of domestic life rather than a purely industrial endeavor. The scene of a miner humming quietly in the corner during a winter evening has become a symbol of modern, efficient energy use.

Hashpower Derivatives Reshape Crypto Mining Investment Landscape

The era of amateur mining with loud home rigs is fading as financial instruments transform the sector. Hashpower derivatives—contracts tied to computing power rather than physical hardware—are creating new avenues for exposure to cryptocurrency mining.

These products range from futures and swaps to tokenized contracts, allowing investors to participate in mining economics without operational headaches. The shift reflects mining's industrialization, where electricity costs and scale determine profitability more than DIY setups.

Risk-Off Start to December Drags Down Stocks and Bitcoin

Global markets opened December with a risk-off tone as equities and cryptocurrencies extended losses. The Dow Jones Industrial Average fell 0.6%, while the S&P 500 slipped 0.7% amid profit-taking after November’s rally. Tech stocks led declines, with the Nasdaq dropping 1% as megacaps like Nvidia and Tesla retreated.

Bitcoin mirrored the selloff, continuing its downward trajectory. Traders await key economic data—particularly the PCE inflation report—to gauge the Federal Reserve’s next move. Markets now price an 85% chance of rate cuts next week, though the central bank’s blackout period has left investors navigating without guidance.

The retreat reflects growing caution. Seasonal optimism for a year-end Santa Claus rally is fading as tariff uncertainties and mixed economic signals weigh on sentiment. Both traditional and digital assets face pressure, with Bitcoin’s slide underscoring the broader risk aversion.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on the provided technical data and prevailing market sentiment, BTCC financial analyst John offers a framework for long-term Bitcoin price predictions. It is crucial to understand that forecasting over such extended horizons involves significant uncertainty, blending cyclical technical patterns with long-term adoption trends.

The current technical setup suggests Bitcoin is in a consolidation phase following a significant rally. The interaction with the 20-day MA and Bollinger Bands will be key for direction in the coming weeks. The broader news sentiment indicates a market weighing macro pressures against strong institutional and structural demand.

| Year | Prediction Framework & Key Drivers | Potential Price Range (Scenario-Based) |

|---|---|---|

| 2025 | Resolution of current consolidation. Outcome depends on holding $82.7K support or breaking $90.3K resistance. Influenced by ETF flows, monetary policy shifts, and potential regulatory developments. | $70,000 - $120,000 |

| 2030 | Post-halving cycle effects. Mass adoption as a digital reserve asset by corporations and nation-states. Network effects and scalability solutions mature. | $250,000 - $500,000 |

| 2035 | Bitcoin as a mature global monetary network. Price driven by scarcity (21M cap), global wealth allocation, and utility as a settlement layer. Growth rate may moderate but from a much higher base. | $800,000 - $1,500,000 |

| 2040 | Fully embedded in the global financial system. Primary value proposition shifts from high growth to capital preservation and absolute scarcity. Market dynamics resemble digital gold/gold. | $1,500,000+ |

John emphasizes that these ranges are not precise targets but illustrate potential trajectories based on continued adoption and Bitcoin's proven historical resilience. Short-term volatility, as seen currently, is a feature of the market but diminishes in significance when viewed through a multi-decade lens focused on its fundamental properties.